I recently wrote about the commercial satellite imagery industry and how fundamentally backwards it is. In that piece, I was mainly addressing companies serving up data derived from the narrow swath of electromagnetic spectrum we humans are most comfortable with — visible light (and its nearest neighbor, infrared light). As it turns out, there’s a whole world of spacefaring companies capturing data about the earth in the oft-overlooked expanses of the electromagnetic spectrum that we humans can’t naturally perceive.

The emerging subset of the industry that I am most excited by is the cluster of companies focused on synthetic aperture radar (SAR), a very complicated-sounding name for an equally complicated technology.

I’ll explain more about what SAR is and why I find it exciting below, but I’d first like to acknowledge companies like Spire Global and Hawkeye 360 that use satellite constellations to measure radio frequencies in order to produce interesting analytic products (a blog post for another day). All too often the “earth observation industry” is reduced to its most familiar use case: pretty pictures of earth. But there’s a growing number of less intuitive, equally compelling types of earth observation that get little attention outside of the occasional profile in space industry trade publications.

A Brief History of SAR

SAR is nothing new. Early airborne experiments were completed in the 1950s. The first spaceborne SAR sensor, Seasat, was launched by the U.S. government all the way back in 1978 — remarkably, much of the data collected by that mission has been made available for free today by NASA. Contemporary SAR constellations like the European Space Agency’s Sentinel-1 mission have enabled a much broader range of researchers and companies to start dabbling in SAR analysis at no cost. And private investment in the commercial side of the industry has ballooned in the last year promising a new wave of high resolution constellations (more on that later).

SAR has some unique properties — it is famously a “24-hour, all weather” sensor, because it can “see” through clouds and at night just as easily as it can “see” during daylight with clear skies. SAR data is anything but human-friendly; after all, it’s measuring microwaves rather than visible light. But it can be processed into derivative products that are interpretable by human eyes, although doing so often means having to eliminate useful information present in the raw data (not altogether too different from color-correcting an optical image for human eyes rather than statistical inference).

Unlike optical imagery, SAR can also be used to derive changes in relative elevation over time, literally measuring which parts of the earth are sinking and which parts are rising. USGS has used SAR to measure land displacement from space going back over 20 years with sensitivity to changes on the order of 5–10 millimeters…from space!

For a full summary of SAR’s unique characteristics, and an explanation of the physics behind how it works, I can’t recommend Daniela Moody’s SAR 101 video enough.

The Commercial SAR Industry: A Cresting Wave of Innovation

The vast majority of SAR innovation over the last forty years has happened behind classified doors. It makes sense — if you’re interested in tracking enemy troop movements at night or mapping post-hurricane destruction under cloudy skies, you can’t use optical imagery even if you can task a satellite at the drop of a hat. Only SAR can “see” in those conditions with global reach, so it has a unique strategic role in defense applications.

In 2008, the existence of the US military’s Lacrosse constellation was declassified, revealing a total of five SAR sensors that were launched between 1988 and 2005 (three of which remain on orbit). Germany, Russia, Italy, Japan, India, and other countries have all launched SAR missions over the years.

Only a handful of commercial companies have successfully launched and serviced SAR satellites to date. MacDonald Dettwiler and Associates (the star-crossed acquirers of DigitalGlobe who late last year were piteously spun back out by their own acquisition target) has been operating a commercial SAR constellation since the launch of RADARSAT-1 in 1995, and is still operating its successor, RADARSAT-2.

But the commercial SAR floodgates are only just now, this year, slamming open.

Why SAR Promises to Revolutionize Commercial Earth Observation

When I say SAR is about to “revolutionize commercial earth observation,” I don’t mean we’re on the precipice of an overnight transformation. What I mean is that aspiring SAR purveyors are collectively ushering the rest of the industry toward a crossroads faster than we would arrive there without them . For years, startup after startup has been pitching the ability to construct an oracle-like prescience about the future and the past — better crop yield prediction, flood modeling, oil inventorying, construction activity monitoring, deforestation alerting, you name it.

Underneath the shiny patina of the average remote sensing startup’s fancy marketing is the implicit promise of contextual, meaningful, automated change detection. Since I started paying attention to the steady stream of remote papers, I think change detection is the single theme that has dominated all others. Sure, technically, it’s possible. But in the practical sense that people imagine when they first hear the term, I think we have a long way to go.

Today’s production-grade change detection algorithms are extremely brittle and narrowly scoped, laborious to create, and incessantly in need of ongoing maintenance. Companies that create them, one client and project at a time, are the opposite of scalable (a Silicon Valley euphemism for fundable).

What is holding the industry back from achieving ubiquitous, coherent, generalized change detection? Four things, in my estimation:

Currently there isn’t an overabundance of high resolution, task-able satellite imagery capacity (especially after the premature death of WorldView 4 last year). Planned constellations like Maxar’s Worldview Legion aim to ameliorate this problem, but the reality today is that you’re going to be fighting over scraps for high resolution imagery, especially if your use case requires lots of revisits.

Even if there were more capacity, the price of imagery has remained stubbornly high despite increasing capacity. Anchored by the price governments are willing pay for imagery to support national defense efforts, satellite operators have struggled to serve most commercial use cases (which often start making economic sense at just a fraction of the current retail prices).

Clouds are a way bigger deal than I like to admit (even to myself). Most of the world is obscured by clouds most of the time — only about 30 percent of the landmass of the earth is completely cloud-free at any given moment. Add to that constraint the vexing fact that you can only “see” during daylight hours, and your window of opportunity for collecting information starts to look like a rigged roulette wheel.

Even if you somehow had access to ample high resolution imagery and you could afford it and you were focused on an area that was rarely ever cloudy…automating the analysis you’d like to perform would likely still be limited by one extremely scarce resource: training data. While the advent of deep learning has enlivened the remote sensing community with far-reaching possibilities, the sad truth is that amassing the requisite volume of annotated imagery remains prohibitively expensive and time-consuming for all but the most highly motivated commercial entities.

Change detection may be the talk of startup town, but in reality most imagery sold to commercial customers is used for a much less exciting purpose: static basemaps. Companies like Apple, Google, Microsoft, Mapbox, and a laundry list of lesser-known web mapping providers purchase high resolution imagery by the boatload in order to make those pristine, cloudless mosaics we’ve all grown accustomed to.

I’m skeptical of the rate at which passive-sensor-derived change detection will become feasible in any context outside of national defense given the challenges I laid out above. Companies like Nearmap and Near Space Labs are aiming to grow the commercial market by providing low-cost aerial imagery over densely populated areas, which is a model I’m hopeful for. Overall, I anticipate a long, slow slog. However…

In my opinion, the most exciting aspect of the impending SAR revolution is that it will accelerate the advent of global, timely change detection.

SAR does not easily address the single largest commercial use case for satellite imagery: static basemaps. It’s not an inherently visual product — it’s an inherently analytic one. SAR’s properties make it ideal for high-revisit, high-resolution activity monitoring and feature extraction. You wouldn’t use SAR to map buildings and roads over a large area — you would use it to figure out which roads are inundated with water during a hurricane, or where new houses are popping up at the outskirts of a fast-growing city.

And unlike the optical portion of the industry (which has experienced merger, after merger, after merger, after merger), the competitive field for SAR providers is experiencing historic expansion. ICEYE, the Finnish startup which made headlines recently after raising $87M in a Series C financing round, has a head start — it currently manages a constellation of 3 satellites with 12 more planned in the next two years. Capella Space’s first satellite reached orbit just over a month ago with plans for 30+ more to come. The Japanese startup Synspective raised $100M and announced the launch of its first satellite will happen this year. PredaSAR announced $25M in funding earlier this year, while Umbra Lab came out of stealth in April as their patent application for a new SAR antennae design became public.

Whew! And that was just a sampling. Seriously.

The Impending SAR Crunch

With so much new SAR capacity coming online over the next year, the question is…what will happen to all of that imagery? If the optical side of the industry is any indicator…a whole lot of nothing, at least for a few years.

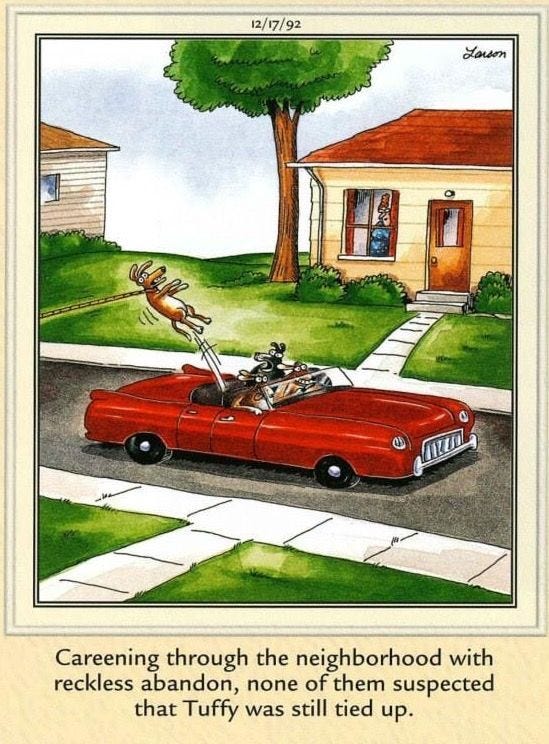

I recently spoke to some graduate students at the University of Pennsylvania, and I described to them a dilemma that the SAR explosion is only going to exacerbate. As an industry, we can’t keep up. We’re like the dog still chained to our traditional analytical tools and proven use cases, speeding away in a convertible fueled by raw satellite imagery…

And that’s a problem in the optical imagery realm, where I can actually explain to my parents what they’re looking at. SAR is far less intuitive, far more fragmented in terms of file type standardization and metadata specification, and enjoys far fewer open source tools for lowering barriers to working with it. It’s a steep learning curve (SAR idiosyncrasies) stacked on top of a steep learning curve (geospatial raster data) stacked on top of a steep learning curve (petabyte-scale datasets in general). Education will take time, and product-market-fit in the diverse verticals that could benefit from SAR-derived analysis will take even more time.

The princely sums that ICEYE, Capella, Synspective, PredaSAR and others have raised suggest a strategy similar to Planet Labs. First: launch a constellation and operate it. Second: build out an analytic product suite and sell derivative information. Third: ???. Fourth: Profit.

The reason for this strategy is that venture capitalists don’t actually want to fund the next Maxar. Personally, I think Maxar is just about the the perfect business: technically interesting, undeniably meaningful, legitimate competitive moat, highly regulated monopoly, etc… but it’s valued at less than 3x revenue on the public market. Satellite imagery companies sell for multiples closer to microchip manufacturers than SaaS companies. Multiple expansion one-time liquidity events are how you make your money back in venture capital, not dividends.

VCs want to fund high-margin software with zero marginal cost at scale. They want the 10–170x revenue valuations (seriously) that SaaS companies enjoy on the public markets. And to make that argument, they encourage their portfolio companies to focus on repeatable subscription revenue. Thus, look for analytics to be sold directly by SAR providers early and often — that will be the narrative hook for pitching future investors (or acquirers) on how they’re really a software play, not a satellite imagery play.

But in-house analytics cannot build a thriving commercial segment on its own. The beauty of the geospatial analysis world is that it cuts across almost every vertical…and in this regard, it is more-or-less impervious to productization. I think of Esri as an analogy: its in-house services are prodigious, but its legendary partner network is what helped grow the overall market at a faster rate than Esri could capture it. For SAR to be successful, a similar ecosystem will need to emerge.

Ursa Space Systems is the most advanced SAR-focused, third-party software and analytics company I can find. They’re extremely well positioned to benefit from the influx of new providers. Cloud to Street is another SAR-savvy company focused on mapping and modeling flood inundation and doing an incredible job at it. But the list of companies like Ursa and Cloud to Street is surprisingly short. I see this gap as a huge opportunity for new company formation — especially folks willing to focus on a single vertical and build a great user experience that masks the complexity of the SAR processing happening behind the scenes.

Well-regarded firms like Orbital Insight and Descartes Labs will undoubtedly add high resolution SAR processing to their ever-expanding list of services — Descartes even recently released a paper describing a SAR-derived deforestation calculation. And Indigo Ag is leading the agricultural charge into SAR — they recently showed off their SAR-derived, country-wide crop monitoring system and added a 45TB of freely accessible processed imagery to AWS. SkyWatch contributed to an open source SAR-processing toolset under ESA’s direction and provides access to Kompsat-5 SAR data via their API. At Azavea, where I work, we’re currently using SAR data on both commercial and government projects, as well as incorporating it into our satellite imagery labeling tool, GroundWork.

The industry has taken note. The most innovative companies are positioning themselves to move quickly. But the revolution won’t happen overnight. It’s going to play out in painstaking slow motion over the next five to ten years. But, one day soon enough, we’ll come to realize that commercial SAR helped crack the code on affordable change detection and, along with it, uncorked a tidal wave of economic value.

The bottom line is this: as an industry, we’ve been promising global-scale monitoring and change detection for years. As SAR goes from “tradecraft” to “trade show,” it’s going to be time to put up… or shut up.

Thanks for this article! Just letting you know that the link to Nearmap is broken (should be https://www.nearmap.com/us/en)