Tomorrow.io and the Future of Weather Prediction

One startup is boldly asking, "What if we could predict the weather?"

Typical disclaimer: yadda yadda yadda, the views expressed herein are my own and no one else’s, this is not investment advice, yadda yadda yadda.

Ayyyy, what’s up nerds? It’s been six months since I last sent out a newsletter. I bet you were starting to think it wasn’t ever gonna happen again! LOL, just kidding. You didn’t even notice that I haven’t been sending out any newsletters, did you?

…Don’t answer that.¹

Something happened yesterday that inspired me to dust off my proverbial sequined leotard and get back out on the dance floor🕺. That thing that happened? Tomorrow.io announced it’s going public via a SPAC. If you don’t know what a SPAC is, go figure it out before returning to finish this post (…and then explain it to me, please).

I know of Tomorrow.io because back in February of this year they announced they’ll be launching their own constellation of radar satellites (and then promptly raised $77M to get ‘er done). They popped up on my radar (😉) again in August when my good friend and fellow knucklehead satellite imagery industry commentator, Aravind Ravichandran, announced that he was joining them as their Director of Strategy. Way to go, Aravind! Wasting no time at all!

Here’s a super underrated perk of SPACs vs. traditional IPOs: instead of a bone-dry SEC filing with dozens of pages of soul-sucking legalese, SPAC deals have to share a slide deck laying out the case for their fundraise publicly on their website. These decks are, I assume, designed for an audience of investment professionals like bankers and pension fund managers. So, naturally, they’re written at about a 7th grade reading level and includes lots of pretty pictures and colorful graphs. Perfect for me.

If you’d like to leaf through Tomorrow.io’s investor presentation yourself, the source material is freely available at the link below. Careful, though, every page is marked “proprietary and confidential” so don’t tell anyone I sent you:

Why is Tomorrow.io Interesting?

You might think a weather prediction startup’s central claim would be that they’ve invented a more accurate way to predict the weather.² Nope. Unnecessary. It turns out most people in the world don’t even have decent weather prediction available to them. That’s what Tomorrow.io is trying to solve—not improving the best models, but making the basics available for everyone globally.

I view this thesis as a specific expression of a very common trend I see in the mapping world. People who live in wealthy, developed countries tend to think that the whole world is already mapped. Like… can’t most people just use Google maps to navigate where they want to go? Nah. Most of the world is explored but it isn’t, like, understood. Turns out weather works the same way.

I was particularly struck by this slide in Tomorrow.io’s deck:

How do they plan to bridge this massive gap? Satellites, baby. How else? They’re launching a bunch of ‘em. According to the deck, at least 32 are planned with the first two going up in 2022. Yeah, I said 2022. I just double checked and that’s…next year? Holy mother of God. That’s really, really soon. I’ll touch on the audacity of that prediction more in the next section.

The investor deck takes quite a bit of care to highlight the value of “active radar” sensors vs. passive radar for the purposes of weather prediction. The “active vs. passive” distinction refers to sensors that measure the specific photons they intentionally beamed down at Earth vs. measuring photons that serendipitously arrived at the sensor from other sources. The consequence of an active radar system, the deck claims, is that it allows for “direct precipitation measurements” whereas passive systems don’t.

I’m unsure of what that exactly direct measurement means in this context, since I was under the impression that passive microwave sensors can also be used to estimate precipitation, but to be honest, the technology angle here is way over my head - I literally work for an active radar satellite company and have no idea how this technology compares to what we’re doing. The distinction between “direct” and indirect measurement is something I need to learn more about. Aw, hell. Who am I kidding? I don’t understand weather prediction and probably never will.

The Rabbit in Tomorrow.io’s Hat

I think the most interesting aspect of Tomorrow.io’s story is that they didn’t start out as a satellite/space company. They’re a software company first and foremost and have built some truly exceptional applications. I mean, just look at their API documentation. It’s beautiful!

The question I keep asking myself…can a small company with consumer-grade software in its DNA really transition into a vertically integrated hardware company? And not just any hardware company—a space hardware company? Hardware is already extremely hard. But hardware that has to work in the cold vacuum of space is hardware on hard mode. It’s hard hardware that has to be hardened. Hard, Hard, Hard.

My (Twitter) friend Dominic Edmunds, CEO of PlanetWatchers, put it fairly succinctly recently:

Brian Chesky (CEO of AirBnB) recently discussed this challenge of stretching a company from one domain to a new one in service of the mission during a podcast interview. My favorite bit was when he recalled advice he had received from a college professor who told him, “Brian…you can do anything you want in your life, just not all at the same time.”

This observation doesn’t mean that Tomorrow.io can’t have its cake and eat it too. It just means that if they are successful they’ll be incredibly hard to compete with. The most valuable companies in the world are both hardware and software companies—Apple, Tesla, Amazon, Google, etc. And I believe the best satellite data providers will necessarily have excellent software. In this regard, Tomorrow.io already has a leg up on the competition.³

But…how are they gonna pull this off? Seriously. In the deck, they specifically point out that they’ve designed their own radar payload. The company I work for has *also* designed its own radar payload, so I have a fairly concrete understanding of what that looks like. Admittedly, I think it’s gotten easier to design, integrate, launch, and operate satellites over the last ten years. I’d estimate that streamlined launch services, off-the-shelf buses and navigation systems, increased access to talent, and increased access to venture capital has brought the challenge down from an intimidating “dedicate your entire life to this” level to a much more reasonable “dedicate three decades of your life to this” level.

The idea that they’ll be launching their first satellites barely more than two years after deciding to start designing them while also running a data-as-a-service business the whole time is such a stunningly ambitious goal that I simply cannot imagine even writing it down let alone committing myself to it. If (and when) they pull it off, I will be slow clapping from the sidelines shaking my head in utter amazement.

They seem aware of what they’ve bitten off, and kudos to them for acknowledging it in their investor deck. In fact, they even put it in bold type:

Money, Money, Money

SPACs are about one thing and one thing only: good storytelling. So it’s not surprising the financials are often kinda the last thing in the deck. But, let’s be honest, they’re also the most interesting part of the deck.

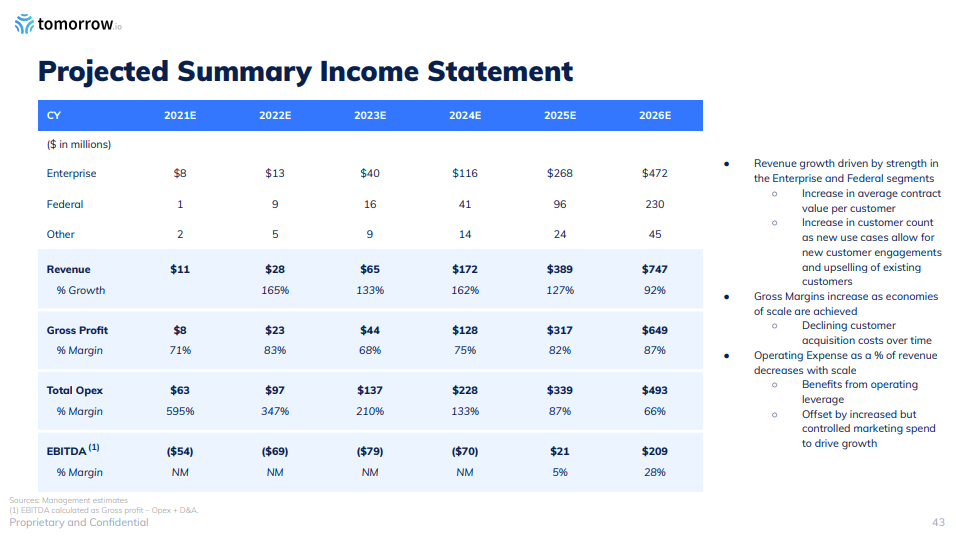

Tomorrow.io’s investor deck explains that the company commands a valuation of 11.1x estimated earnings in 2023 which, conveniently, are about 6x the estimated earnings for this year of $11M. Revenue is expected to balloon to $472M in five years time while margin on that revenue casually expands from 71% to 87%. They project $276M in free cash flow in that fifth year (2026). That business would be worth a lot more than $723M or whatever they’re pegged at today. In fact, that would be one of the best businesses in the history of businesses.

Here’s the surprising thing to me. They’re sitting on $102M TODAY. Even before they do this fundraise! All-in-all, the SPAC is expected to inject another $420M (nice) into the business. There’s a real chance that when the dust settles they’re gonna be sittin’ on half a billion dollars of dry powder. All I’m saying…the trade show swag is gonna be absolutely lit.

Whether these numbers are sensible or not is not for me to comment on. I don’t own individual stocks in companies I don’t directly work for, and I won’t be changing that policy any time soon. I’ll say this as someone with absolutely no skin in the game:

The problem they’ve articulated (lack of satisfactory weather forecasting in most of the world) is undeniably enormous

They are a real company with a real product that makes real revenue and is growing real fast

If they pull of the constellation, that’s gonna be a deeeeeeeep competitive moat that few will even attempt to swim across

Half a billion in cash money, though. My goodness, gracious! Papa’s got a brand new bag!

A Pattern for the Future of the Earth Observation Industry?

SaaS startups are very regularly faced with the annoying question, “what’s stopping Google from doing this?” In the space industry, you just have to substitute SpaceX in that sentence if you want to sound smart. Every space tech entrepreneur has polished their answer to that one annoying question into a smooth reflective pebble of wisdom that gracefully avoids implying that they’re safe because, realistically, what they’re working on is so obscure it’s literally not worth SpaceX’s time to even consider.

The more troubling question is…what’s preventing every tech-savvy data company in the industries you sell into from moving up the stack? Why not own their own private constellation and throw you away like an old pair of gym socks? Tomorrow.io is doing it! Who’s next??

Before joining Umbra, I would have told you this will probably be a huge trend. It makes so much sense—the same barriers to entry that are toppling for startups launching constellations are making it easier for existing companies to consider dabbling.

But before Umbra, I didn’t fully appreciate the insanity of trying to moonlight as a space tech company. Reading through Tomorrow.io’s deck, one thing is clear: this is not a side hustle. They are pivoting the entire company to a new identity and going all-in on satellites. In fact, coincident with the announcement they were launching a constellation they completely rebranded the company from Clima Cell to Tomorrow.io.

It takes a deep-down-feel-it-in-your-bones level of commitment to go after a vision like Tomorrow.io’s. How many companies are willing to fundamentally change who they are in order to launch a satellite constellation successfully? I would guess very few.

So, I slept easy last night. I think Tomorrow.io is potentially on to something very, very big. And I am rooting for them. I think they’ll be successful precisely because it’s hard to pull off. They’ll become a famous counter-example, an exception to the rule (like almost all extremely valuable companies tend to be).

P.S. Congratulations to Planet for getting listed on the New York Stock Exchange this morning! Just another week in the satellite imagery industry.

¹ I’ve actually been writing way more than I’ve ever written in my whole life. Unfortunately, it’s mostly emails.

² But just in case they do want to make their weather forecasting better…you know how old people with hip replacements always feel a storm coming way before it happens? Tomorrow.io should incorporate real-time feedback from assisted living communities across the country into their models. That’s a million dollar idea.

³ You can even compete with free data if it’s cumbersome enough to access. Have you ever tried to download data from a NOAA website, for instance?